Become a Titan in Your Retirement Future

Helping you feel confident in reaching your investment, financial and insurance needs.

We Take the Guesswork Out of Finances

At Coeus Financial, we specialize in helping clients address their investment, financial and insurance needs through customized strategies designed for their specific goals. We don’t deal in guesswork, emotion or whims. Our work is always based on data, research and scientific methodology so you have the best information to make the best financial decisions for your situation.

Why do we call ourselves Coeus? In Greek mythology, Coeus was a Titan, the son of the primordial deities of Heaven and Earth. His name means questioning. We relate to Coeus because we are always questioning. By asking the right questions, we can drill down to get to the right strategies for our clients as we work together to achieve their lifetime financial goals. With Coeus Financial, you have a titan in your corner.

We have been serving individuals, families, business owners, near-retirees and retirees in California and beyond since 2013. We are ready to serve you too.

Titan-Level Planning & Services

When you partner with us, we strive to be a one-stop shop for all for all your financial, investment and insurance needs. We offer holistic planning that encompasses accumulation, growth, management and protection of your assets. All services are customized and based on the unique needs and situation of each individual client. Key services offered by our firm include:

Investment Management

401(k) Rollover & Roth IRA Strategies

Retirement Income Planning

Estate Preservation

Wealth Management

Insurance Strategies

Tax Mitigation

Social Security Maximization

Financial Planning

5 Simple Steps to a Successful Retirement: Make Your Retirement a Blockbuster

Download your complimentary copy to learn how you can take your retirement strategy from flop to blockbuster with these simple strategies.

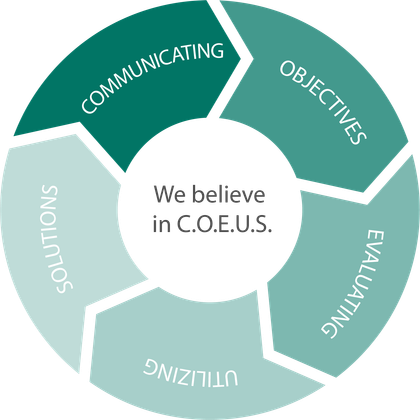

We Make Progress Through Process

When we work with our clients, we make Progress Through Process. When there is a solid process in place with an end-goal in mind, the chances of success greatly improve. We are all about championing financial and retirement success for our clients and do so through our tried-and-true COEUS process.

Communicating

We get to know you and your goals.

Objectives

We solidify your financial and retirement objectives.

Evaluating

We evaluate current and new strategies.

Utilizing

We utilize all the resources to achieve your goals.

Strategies

We put strategies in place and monitor over time.